Vous emménagez dans une résidence ou un bâtiment au gaz naturel?

Communiquez-nous votre nouvelle adresse aussitôt que vous connaissez votre date exacte de déménagement.

Joignez votre énergie à la nôtre!

Pensez votre carrière autrement

Chez Énergir, on pense l'énergie humaine autrement. Au-delà de la productivité, on mise sur le bien-être de nos employés, sur les défis stimulants et sur la solidarité.

Gaz naturel liquéfié

Des capacités additionnelles de gaz naturel liquéfié (GNL) sont maintenant disponibles au Québec.

Gaz naturel renouvelable

Transformer en énergie des matières organiques comme nos déchets de table : voilà une solution concrète dans la lutte aux changements climatiques.

À propos d'Énergir

Tour d'horizon d'Énergir afin d’en apprendre davantage sur ses activités énergétiques, son bilan, son historique et sa structure d'entreprise.

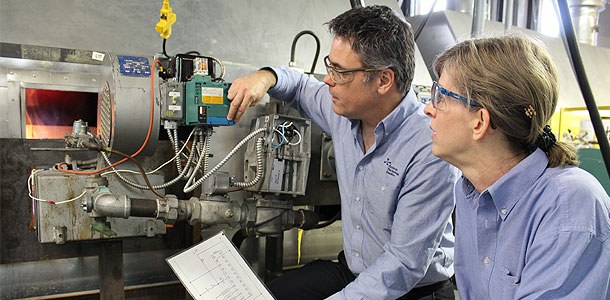

Formations à l'ETG

L’École de technologie gazière procure à la main-d’œuvre de l’industrie une gamme complète de services de formation.

La lutte aux changements climatiques

À titre de joueur majeur dans le domaine de l’énergie au Québec comme au Vermont, Énergir tient à apporter une contribution positive à la collectivité et à réduire son empreinte environnementale dans chacune des actions qu’elle entreprend. Voyez comment Énergir met le cap sur 2030 et au-delà grâce à des mesures concrètes pour faire partie de la solution et atteindre ses ambitions climatiques.

Ambitions climatiques :

-37,5 %

des émissions de GES liées à nos opérations par rapport à celles de 1990 d'ici 2030

-30 %

des émissions de GES pour l'utilisation du gaz naturel

dans le secteur du bâtiment desservi par Énergir d'ici 2030

Carboneutralité

de l'énergie distribuée d'ici 2050

Efficacité énergétique

Des solutions pour réduire votre consommation d'énergie

Énergir est constamment à la recherche de solutions optimales pour aider ses clients à mieux et moins consommer l’énergie. Ce sont plus de 130 000 projets d’efficacité énergétique qui ont été réalisés chez nos clients depuis 2001. Nos programmes d’efficacité énergétique facilitent l’intégration de ces projets.

Pour votre résidence

Énergir offre des subventions pour encourager l'efficacité énergétique.

Pour votre entreprise

Énergir offre des subventions pour encourager l'efficacité énergétique.